Which company has the most car insurance discounts for you?

How to save big money on auto insurance

Expensive

maintenance, stinging state fees and fuel tank fill-ups can make owning

a car a pricey proposition. Your car insurance may represent one of the

few areas for possible savings. If you haven't reviewed your policy in a

while, you might be missing out on a multitude of valuable discounts.

Discounts are an important way consumers can narrow the field when it comes to choosing a provider.

"One

of the most important things is to advocate for yourself. Ask what

discounts are available," says Jim Whittle, assistant general counsel

and chief claims counsel of the American Insurance Association. "There's

a whole slew of discounts in the marketplace."

Save on your auto insurance -- compare quotes from reputable insurers

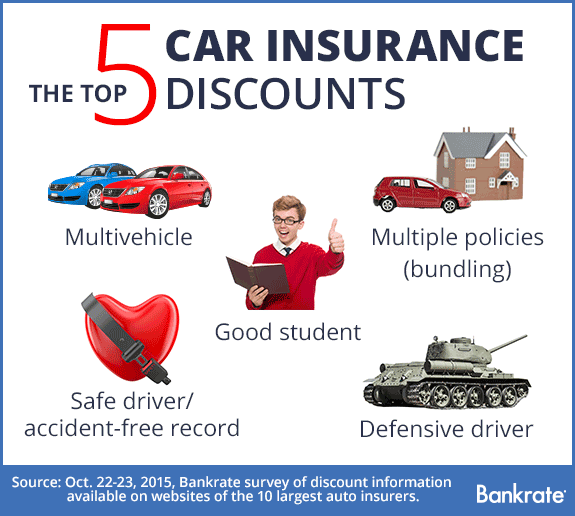

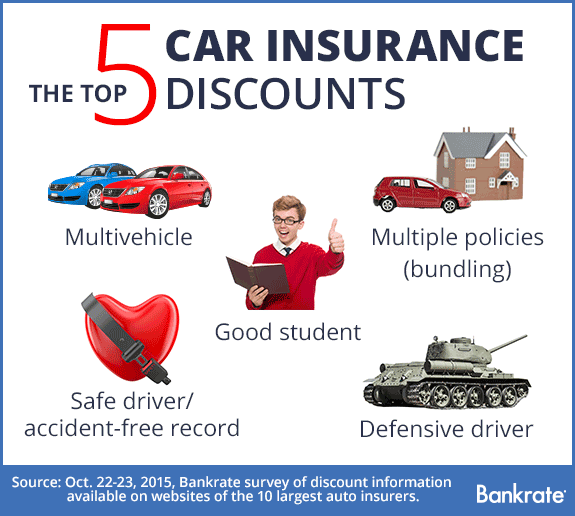

To

help you find the best deal, Bankrate has updated its table of popular

discounts found on the websites of the 10 largest auto insurers.

Note: Some discounts not available in all states.

Results

found in Oct. 22-23, 2015, survey of discount information available on

the websites of the 10 largest car insurance companies. The list of top

10 car insurers is by market share in 2014, according to the National

Association of Insurance Commissioners.

We did the digging for you

We

unscientifically, but meticulously, dug through the depths of insurers'

websites and sifted through sometimes intricate wording about discounts

to save you from doing the heavy lifting.

Many well-known car

insurance discounts are spelled out prominently on companies' websites.

State Farm's website, for example, states that you can save up to 20% if

you have 2 or more vehicles in the same household insured by people who

are related.

Nationwide, like all the insurers, has a main list

of discounts on its website. If you search further for discounts by

state, you'll find various additional reductions that may be possible

where you live, including discounts if your vehicle is newer or has air

bags.

On some sites, details about certain discounts can be found only in Q&A sections or in blog posts.

On some sites, details about certain discounts can be found only in Q&A sections or in blog posts.

As

in past years, Bankrate has found a trend toward more discounts,

including one that's new to our chart: 3 of the top 10 now give a price

break on auto insurance if you own your own home or condominium.

How should you use this information?

The

most important thing consumers can do to find the best car insurance

rate is shop around, even if you don't plan on switching providers.

Request quotes from multiple insurers and see the savings that each can

offer. Be sure to inquire about discounts detailed on our chart.

"If

you are out looking for a product, you know what you want in terms of

coverage, you know what premiums would be, you find out what discounts

are available," Whittle says. "Everyone should be asking when they get a

quote, 'What discounts are available? What discounts might I qualify

for?'"

Some auto insurers use a method known as "price

optimization" to figure out which customers are likely to

comparison-shop versus which customers aren't, says Amy Bach, executive

director of the insurance consumer group United Policyholders. In some

instances, you can end up being punished for being loyal to your

insurer, she says.

Be proactive against rising costs

"If

they find out that you're not going to shop and compare, they may say,

'We're going to give you a discount for having good grades,'" Bach says.

"But that actually may mask the fact that they may be charging you

more, based on the data-mining that they found."

To avoid being on

the losing end of price optimization or missing out on discounts, it's

critical to comparison-shop for the best auto insurance policy.

"Anybody

who doesn't take advantage of the opportunity to shop is probably

putting themselves at a disadvantage," says Bob Passmore, assistant vice

president of personal lines policy at Property Casualty Insurers

Association of America.

"The cost of a lot of insurance goes up by

the cost of everything else," he says. "The cost of taking care of the

aftermath in accidents -- medical care and auto body repair -- continues

to go up, and that's going to be reflected in the insurance premiums we

all pay."

Don't get overwhelmed!

When shopping for an

insurance policy, you may get wildly varying quotes from one insurer to

the next. And when you factor in the different discounts each insurer

provides, you can easily feel overwhelmed.

"The best thing to do

is take your current coverage out and ask for quotes for the same

thing," Passmore says. "Make sure you're getting the same limits quoted,

the same optional coverages quoted. … Somebody could give you a quote

for a minimum-limits policy that will look really cheap, but it might be

half or a quarter of the limits that you already have."

Bach says it's also important to ask insurers about their rules for raising rates and surcharging you if you file a claim.

"Find

out, 'OK, if I have a fender bender where no one gets hurt, is that

going to make my rate go up? Does every claim make my rate go up?'" she

says.

And when it comes to discounts, don't take what's presented

on insurers' websites as the final word. Ask if there are any other

discounts available.

"It's always worth asking the question," Passmore says.

On some sites, details about certain discounts can be found only in Q&A sections or in blog posts.

On some sites, details about certain discounts can be found only in Q&A sections or in blog posts.

0 التعليقات:

إرسال تعليق